Alipay, the brand of Ant’s consumer finance app, claims to earmark 1.3 billion annual active users as of March. The majority of its users came from China, while the rest were brought in by its nine e-wallet partners in India, Thailand, South Korea, the Philippines, Bangladesh, Hong Kong, Malaysia, Indonesia and Pakistan.

TechCrunch , July 15, 2020

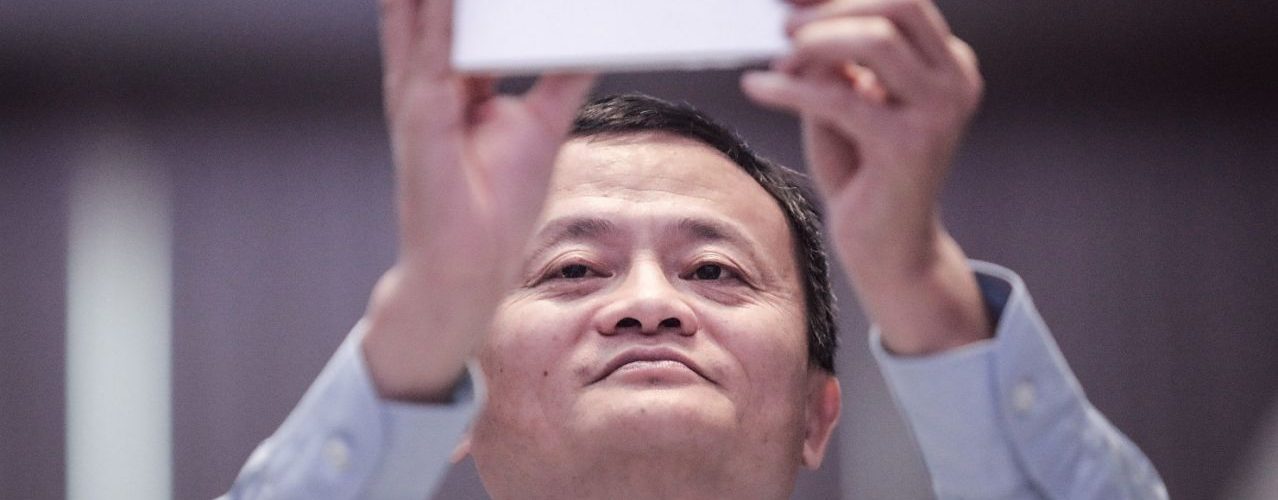

Jack Ma’s fintech giant tops 1.3 billion users globally

The speculation that Alibaba’s fintech affiliate Ant Group will go public has been swirling around for years. New details came to light recently. Reuters reported last week that the fintech giant could float as soon as this year in an initial public offering that values it at $200 billion. As a private firm, details of the payments and financial services firm remain sparse, but a new filing by Alibaba, which holds a 33% stake in Ant, provides a rare glimpse into its performance.

Alipay, the brand of Ant’s consumer finance app, claims to earmark 1.3 billion annual active users as of March. The majority of its users came from China, while the rest were brought in by its nine e-wallet partners in India, Thailand, South Korea, the Philippines, Bangladesh, Hong Kong, Malaysia, Indonesia and Pakistan.

In recent years Ant has been striving to scale back its reliance on in-house financial products in response to Beijing’s tightening grip on China’s fledgling fintech industry. Tencent, Alibaba’s nemesis, is considered a lot more reserved in the financial space, but its WeChat Pay app has been slowly eating away at Alipay’s share of the payments market.

In a symbolic move in May, the Alibaba affiliate changed its name from Ant Financial to Ant Group. Even prior to that, Ant had been actively publicizing itself as a “technology” company that offers payments gateways and sells digital infrastructure to banks, insurance groups and other traditional financial institutions — rather than being a direct competitor to them. On the Alipay app, users can browse and access a raft of third-party financial services, including wealth management, microloans and insurance.

As of March, Ant’s wealth management unit facilitated 4 trillion yuan ($570 billion) of assets under management for its partners, offering money market funds, fixed income products and equity investment services. During the same period, total insurance premiums facilitated by Ant more than doubled from the year before.

In June, Ant’s new boss Hu Xiaoming set the goal for the firm to generate 80% of total revenues from technology service fees, up from about 50% in 2019. He anticipated the monetary contribution of Ant’s own proprietary financial services to shrink as a result.

Ant grew out of Alipay, the payments service launched by Alibaba as an escrow service to ensure trust between e-commerce buyers and sellers. In 2011, Alibaba spun off Ant, allegedly to comply with local regulations governing third-party payments services. Ant has since taken on several rounds of equity financing. Today, Alibaba founder Jack Ma still controls a majority of Ant’s voting interests.

Source TechCrunch