GoCardless has a shot at becoming a global leader when it comes to payments via direct debit. And now, all eyes are on the company’s next challenge — becoming the best way to collect recurring payments, globally. The startup’s CEO will join us to talk about how GoCardless plans to replace cash, cheques and even card payments at a global scale.

TechCrunch , 16th December, 2019

PLEASE ALSO READ

GoCardless Creating the Best Way to Collect Recurring Payments Globally

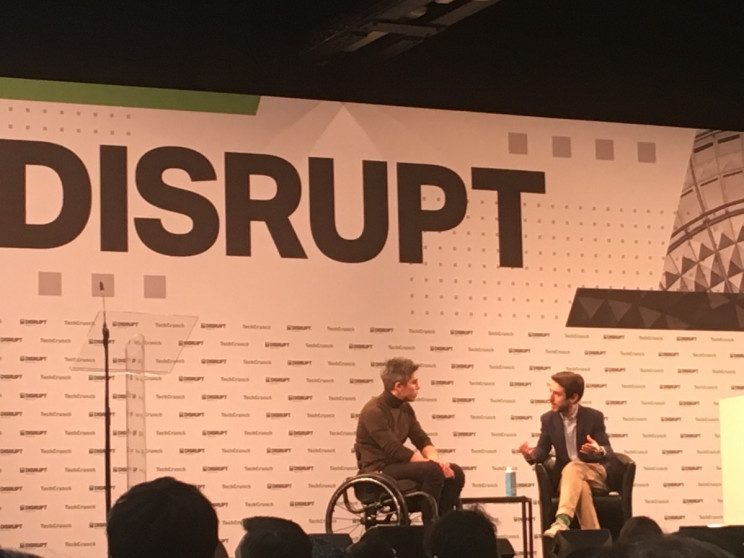

CEO Hiroki Takeuchi took to the TechCrunch Main Stage in Berlin to talk about the future of global recurring payments.

By Fabienne Lang , Interesting Engineering

December 11, 2019

TechCrunch Disrupt is currently happening in Berlin, Germany, where tech startups, investors, and sponsors unite. Innovation is at the forefront of the conversations.

One such company is GoCardless, which has been operating for nine years and plans on becoming the best way of collecting recurring global payments.

GoCardless CEO, Hiroki Takeuchi, talked about the company on the Main Stage of the event on Wednesday.

What does GoCardless do?

The main aim of GoCardless is to help businesses with payment models to collect payments. What GoCardless wants to create is a smooth and seamless method of creating recurring payment models on a global level.

Currently, recurring models don’t work well, so Takeuchi and his team are working hard to change this.

For instance, GoCardless is a great option for paying online utility bills — something we have to do each and every month recurringly — but it’s also useful for different business models.

The company works with 50,000 businesses globally, and their clients range from one-man-bands, accounting firms, to big names such as DocuSign and Xero.

Is there friction about giving and saving banking information directly online, instead of the usual credit card method?

GoCardless’ method is asking customers to save their banking details directly online with specific companies, instead of inputting their credit card details each and every time they purchase or pay for something.

Naturally, one issue that could arise for many people is saving their banking details online. However, Takeuchi stated that this has not, in fact, been an issue.

For instance, most European countries prefer using direct debit methods instead of credit cards. In the U.S. it’s a different story, however, as credit cards are still very widely used. So there are still challenges to overcome.

On the matter of fraud, Takeuchi stated that this varies from country to country.

How can a local payment go global?

With an increasingly globalized world, there is still the issue of localized banking systems. Direct debits are currently constrained to localized banks.

GoCardless is trying to bridge that gap, and connect all the dots into a single platform. Currently, the company has 30 countries signed up on its platform.

Takeuchi agreed with the comment that GoCardless aims “to become the Visa of direct debit.”

Their biggest competition remains credit cards, however, Takeuchi said that this type of payment is best suited for retail, and not necessarily for recurring online payments. So GoCardless has good scope there.

Furthermore, by partnering up with TransferWise as they have done, currency no longer remains an issue.