Klarna Bank AB co-founder and CEO Sebastian Siemiatkowski discusses the company’s latest funding round led by SoftBank Group, giving the Swedish fintech startup a valuation of $45.6 billion. He shares more details about the rapid growth of the ‘buy now, pay later’ trend in e-commerce and says Klarna has no plans to go public yet in the near future. Siemiatkowski also says he’s worried about the way cryptocurrency is being advertised and the financial risks for people who don’t truly understand the digital asset.

Bloomberg Technology, Jun 12, 2021

PLEASE ALSO READ

Klarna secures additional funding as consumers demand smarter alternatives to shop, bank, & pay

Klarna, 10 Jun 2021

New York, 10 June 2021 Klarna, the leading global payments provider, retail bank, and shopping service, today confirms a new equity funding of USD 639 million. The round was led by SoftBank’s Vision Fund 21 ,with additional participation from existing investors Adit Ventures, Honeycomb Asset Management and WestCap Group, to support international expansion and further capture global retail growth. Klarna’s other investors include Sequoia Capital, SilverLake, Dragoneer, Permira, Commonwealth Bank of Australia, Bestseller Group, Ant Group, Northzone, GIC – Singapore’s sovereign wealth fund – as well as funds and accounts managed by BlackRock and HMI. The post-money valuation of Klarna is USD 45.6 billion and remains the highest-valued private fintech in Europe and the second-highest worldwide2. As part of the GiveOne initiative established by Klarna earlier this year, 1% of this equity raised will be directed to initiatives supporting planet health.

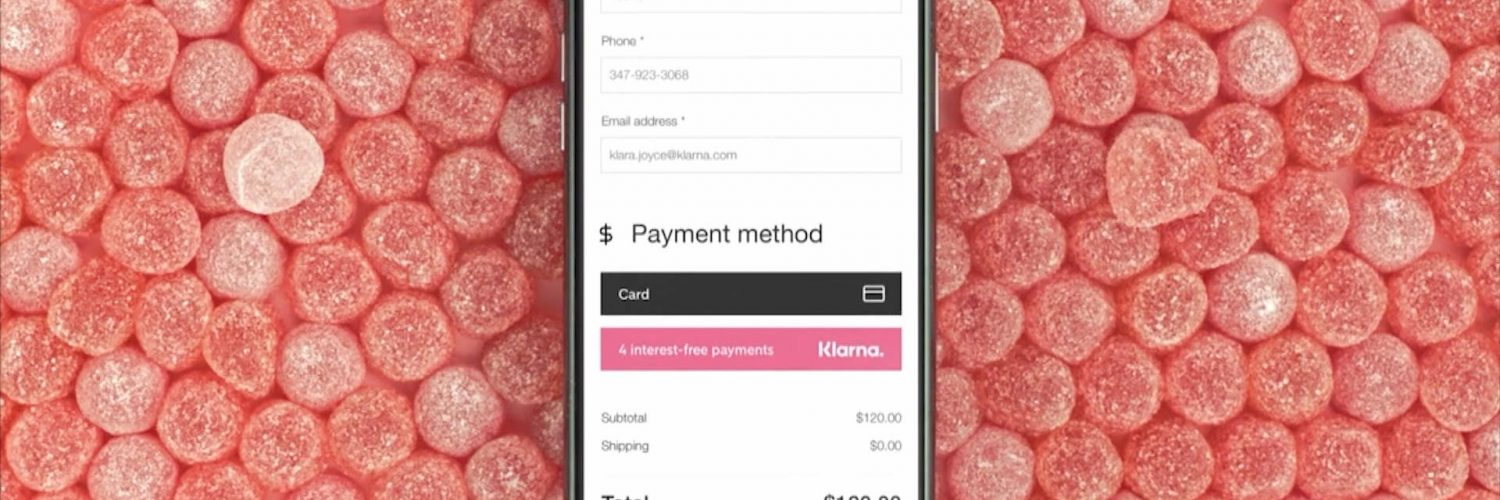

Klarna enables consumers to shop, pay and bank in a smarter way, designed to fit the lives they lead, rather than the requirements of the traditional payments and banking industry. The ongoing structural shift of consumers turning away from revolving credit lines where they incur interest or fees to debit and simultaneously seeking superior retail experiences means Klarna’s healthier, more transparent and convenient alternatives, which put consumers in control are closely aligned to evolving global consumer preferences and drive global growth.

Sebastian Siemiatkowski, Klarna Founder and CEO said: “Consumers continue to reject interest-and fee-laden revolving credit and are moving toward debit while simultaneously seeking retail experiences that better meet their needs. Klarna’s more transparent and convenient alternatives align with evolving global consumer preferences and drive worldwide growth. I’m very proud of the investors who are supporting Klarna’s ambition to challenge these outdated models to empower consumers with fair, transparent, and convenient products to help them bank, shop and pay each day.”Yanni Pipilis, managing partner for SoftBank Investment Advisers said: “Klarna’s growth is founded on a deep understanding of how the purchasing behaviors of consumers are changing, an evolution which we believe is accelerating. Klarna has already successfully expanded into the US and we are excited to continue supporting the team in bringing the next generation of financial services to new markets worldwide.”

Eric Munson, founder and CIO of Adit Ventures said: “Adit Ventures is a proud Klarna investor. We are excited to watch this unique brand continue to challenge the boundaries of modern payments, banking, and shopping. Klarna’s rapid growth has been a testament to their innovation, leadership, and execution—however, we believe the best is yet to come as Klarna multiplies their addressable market through global expansion.”

David Fiszel, founder and CIO of Honeycomb Asset Management said: “Honeycomb is proud to add to our earlier investments in Klarna. We are excited to support its long-term global growth initiatives and mission to redefine the consumer purchasing experience at scale. Klarna truly is a unique founder-led company with a world-class management team focused on innovation in the rapidly-growing fintech sector.”

Charlie Young, partner at WestCap commented: “Klarna is leading a revolution in consumer preference, and has already reimagined the payments, eCommerce, and banking experience for tens of millions of people. Klarna’s global scale and leading market position create even more opportunity for the business going forward. WestCap is pleased to partner with Klarna at this exciting moment in the company’s history.”

Klarna is available direct to consumers via the company’s shopping app, used by 18m customers worldwide as well as at over 250,000 retailers globally. In the app, consumers can browse and shop at any brand online with Klarna payment options, allowing them to pay immediately or later, manage spending and available balances, add favorite items to collections, initiate refunds, access tailored discounts, receive price-drop notifications, track deliveries intelligently and join Klarna’s loyalty program, Vibe.